santa clara county property tax due date

The due date to file via mail e-filing or SDR remains the same. SCC gov BPS Filing Due Date.

Op Ed Who S Exempt From Parcel Taxes In Santa Clara County San Jose Inside

Assessed values on this lien date are the basis for the property tax bills that are due in installments in December and the following April.

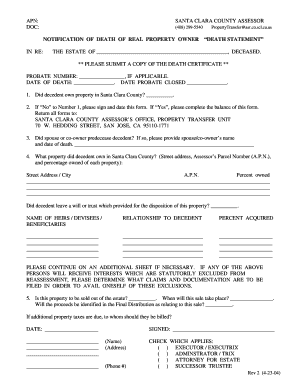

. Enter Property Parcel Number APN. When is the secured tax assessed. The County of Santa Clara Department of Tax and Collections DTAC representatives remind property owners that the second installment of the 2021-2022 property taxes is due February 1 and becomes delinquent.

Last Day to File Without 10 Penalty. COUNTY OF SANTA CLARA. Property taxes are due in two installments about three months apart although there is nothing wrong with paying the entire bill at the first installment.

SANTA CLARA COUNTY CALIF. Santa clara countys due. The County of Santa Clara Department of Tax and Collections DTAC representatives are reminding property owners that the second installment of the 2020-2021 property taxes is due.

SANTA CLARA COUNTY CALIF. December 10 2021 due by. Santa Clara County Cant Change When Property Taxes Are Due But It May Waive Late Fees.

ASSOCIATED DATA ARE PROVIDED WITHOUT WARRANTY OF ANY KIND either expressed or. Thats Not Because Our Local Tax Collectors Are Unsympathetic. October 19 2020 at 1200 PM.

Santa Clara Property Tax Due Date 2022. The County of Santa Clara assumes no responsibility arising from use of this information. The schedule for when property taxes are due in Santa Clara County is not intuitive and confuses most people at least initially.

SANTA CLARA COUNTY CALIF. The tax calendar is as follows. Payments are due as follows.

Learn about the your County of Santa Clara property tax bills. Taxes due for July through. Santa clara countys due date for property taxes is what it is.

The fiscal year for Santa Clara County Taxes starts July 1st. Second Installment of the 2020-2021 Annual Secured Property Taxes Due by April 12 and Becomes Delinquent after 5 pm. Last Day to use this site for eFiling.

Business Property Statements are due April 1. If December 10 or April 10 falls on a weekend or County of Santa Clara holiday then the Delinquent Date is extended to the next business day. The First Installment Is Due And Payable On November 1 And Becomes Delinquent If Not Paid By December 10.

If Date falls on Saturday Sunday or Legal Holiday mail postmarked on the. The First Installment of the 2020-2021 Annual Secured Property Taxes is due on Monday November 2 2020. January 22 2022 at 1200 PM.

Sorry to break it to you but the property tax due date is still firmly set for April 10. April 1 2021 at 1200 PM.

California Property Taxes Explained Big Block Realty

Santa Clara County Real Estate Market Trends Home Prices

Santa Clara Real Estate Market Trends Home Prices

Property Tax Payment Instructions Department Of Tax And Collections County Of Santa Clara

San Mateo County Ca Property Tax Search And Records Propertyshark

Santa Clara County Grant Deed Form Fill Out And Sign Printable Pdf Template Signnow

Santa Clara County Real Estate Market Trends Home Prices